Introduction

“Get an Allied Car Insurance Quote Online — Fast, Free & Reliable” Finding the right auto insurance shouldn’t feel complicated. With an Allied car insurance quote, you get a simple, reliable way to see how much coverage will cost for your vehicle and lifestyle. Allied makes the process quick—just enter a few details online, and you’ll receive an estimate tailored to your needs. Whether you’re a first-time driver, a family with multiple cars, or someone looking to switch providers, getting a quote helps you compare options and unlock potential discounts. Best of all, requesting a quote is free, fast, and won’t affect your credit score.

How to Get an Allied Car Insurance Quote

Getting your Allied car insurance quote is quick and stress-free. Start by entering your ZIP code, vehicle details, and basic driver information. The system then creates a personalized estimate based on your coverage needs and budget. You can request your quote online in just minutes or connect with a local Allied insurance agent for guidance. This step-by-step process makes comparing options easier, so you can choose the right policy and start saving on auto insurance today.

What You’ll Need Before Requesting a Quote

Before you request an Allied car insurance quote, it’s helpful to gather a few details. You’ll need your driver’s license, vehicle identification number (VIN), and your car’s mileage. Having your current or previous insurance policy handy can also make the process smoother. If more than one driver or vehicle is on the policy, their information will be required too. Providing accurate details ensures you receive the most reliable estimate, helping you compare coverage types, discounts, and pricing without delays.

Allied Car Insurance Coverage Options Explained

An Allied car insurance quote gives you more than just a price — it shows the different types of coverage available. Allied offers standard protections like liability insurance to cover damages to others, plus collision and comprehensive coverage for repairs to your own vehicle. You can also add medical payments and uninsured/underinsured motorist coverage for extra peace of mind. For more protection, Allied includes options like roadside assistance, towing, rental reimbursement, and gap insurance. Whether you want basic liability or full coverage, Allied helps you customize a policy that matches your budget and driving needs.

Factors That Affect Your Allied Insurance Quote?

When you request an Allied car insurance quote, several factors influence the final price. Your driving history, age, and experience on the road play a big role — safe drivers usually enjoy lower rates. The vehicle’s make, model, and year also matter, since newer or luxury cars often cost more to insure. Your ZIP code can impact pricing too, with urban areas generally having higher premiums. Finally, the coverage limits and deductibles you choose directly affect the cost. Understanding these factors helps you compare quotes wisely and find the right balance between protection and affordability.

Discounts That Can Lower Your Allied Car Insurance Quote

One of the best ways to save money on your Allied car insurance quote is by taking advantage of available discounts. Allied rewards safe drivers with lower rates and offers good student discounts for young drivers with strong grades. You can also save by bundling auto and home insurance or insuring multiple vehicles under one policy. Installing anti-theft devices or completing a defensive driving course may reduce your premium even further. These savings add up quickly, making it easier to secure quality coverage at a price that fits your budget while still enjoying reliable protection.

Allied Car Insurance Reviews & Customer Ratings

When choosing coverage, customer feedback can be just as important as the price of your Allied car insurance quote. Reviews highlight that Allied is known for offering affordable rates, helpful discounts, and flexible coverage options. Many policyholders appreciate the ease of getting quotes online and the option to work with local agents. On the other hand, some reviews mention that claims processing may take longer than expected in certain cases. Overall, Allied earns solid ratings for affordability and convenience, making it a competitive option compared to larger insurance providers. These insights help drivers feel more confident when selecting a policy.

Allied vs Competitors — How Does It Compare?

When reviewing an Allied car insurance quote, it’s smart to see how it stacks up against other providers. Compared to Geico, Allied often shines with personalized service through local agents. Against Progressive, it offers competitive pricing and solid multi-policy discounts. While Allstate is known for nationwide coverage, Allied can feel more approachable for families and small businesses. In terms of affordability, Allied frequently competes with Nationwide, especially when bundling auto and home policies. What sets Allied apart is its balance of customized coverage, discount options, and agent support, which larger carriers sometimes lack. This makes Allied a strong choice for drivers seeking both value and reliable service.

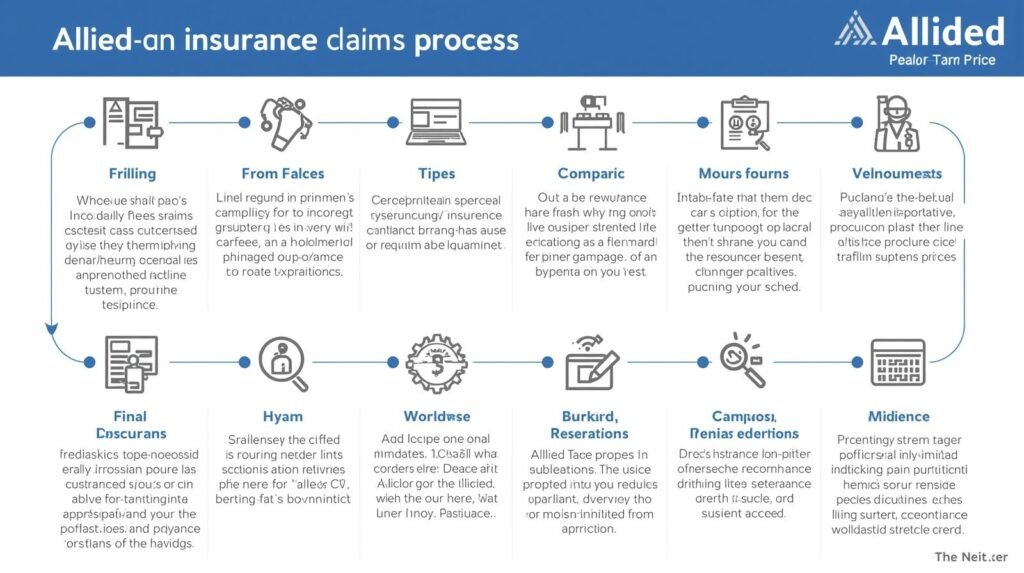

The Allied Insurance Claims Process

Knowing how claims work is just as important as getting an Allied car insurance quote. If you’re in an accident, you can file a claim online, by phone, or through your local Allied insurance agent. The process starts with sharing details about the incident, including photos or police reports if available. Allied then reviews your claim, assigns an adjuster, and updates you on repair or settlement progress. While some customers note that response times vary, most find the process straightforward. Having clear claims support gives peace of mind, ensuring you’re not just buying a policy but also reliable help when you need it most.

Local Allied Insurance Agents Near You

While getting an Allied car insurance quote online is quick, many drivers prefer the personal touch of a local agent. Allied partners with agents across different regions to provide one-on-one guidance, helping you understand coverage options, discounts, and claims. Local agents can also give advice tailored to your community, whether it’s city driving risks or rural coverage needs. This mix of online convenience and local expertise makes Allied stand out. Finding an agent near you is simple—just search by ZIP code or call Allied directly. Having a trusted advisor nearby ensures you get coverage that truly fits your lifestyle.

FAQs About Allied Car Insurance Quotes

Q1. How long does it take to get an Allied car insurance quote?

Most quotes are ready in just a few minutes online or through an agent.

Q2. Will requesting a quote affect my credit score?

No, getting an Allied auto insurance quote will not impact your credit.

Q3. Can I purchase coverage immediately after receiving my quote?

Yes, you can buy a policy right away online or through an agent.

Q4. What discounts are available with Allied?

Drivers may qualify for safe driver, multi-policy, good student, and anti-theft discounts.

Q5. Is Allied available in every state?

Availability may vary, so check by entering your ZIP code during the quote process.

Conclusion

Getting the right coverage doesn’t have to be complicated. With an Allied car insurance quote, you can explore flexible policies, compare savings, and choose protection that truly fits your needs. From affordable rates to helpful discounts and trusted local agents, Allied makes the process simple and reliable. Whether you’re a new driver, a family with multiple cars, or someone looking to switch providers, now is the perfect time to check your options. Start today — get your free quote online in minutes or connect with an Allied agent near you.

Leave a Reply